Kagadi-The distribution of income tax assessments by a team of Uganda revenue authority has created anxiety among the business community in Kagadi town, Kagadi district.

The business people are bothered by the amount of money levied on their businesses for the period of 2019 and 2020 respectively.

They have asked their leaders to intervene before they desert Kagadi town.

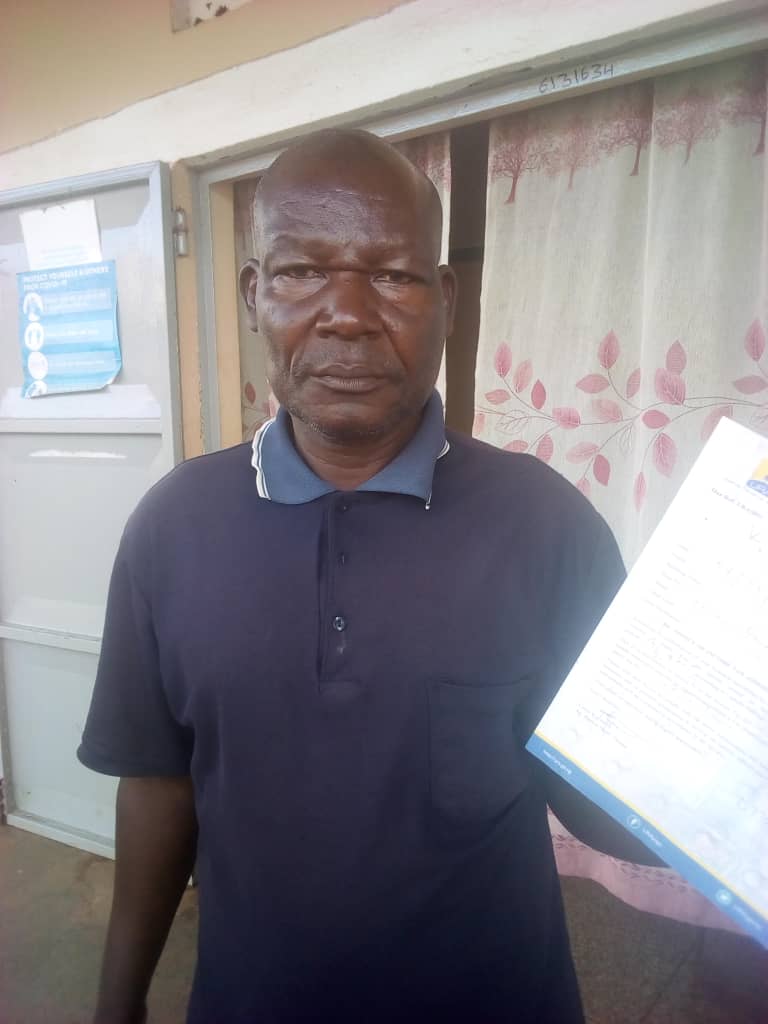

Matia Musoke dealing in retail blamed the URA team for just ambushing the businesspersons and levying exorbitant taxes on their businesses.

Charles Kakatira, the chairperson LC1 of Kagadi central and a dealer in Hotel has threatened to commit suicide over exorbitant levied on his business. He was asked to pay 3m shillings.

In an interview with our reporter, Cyrus Kayumba, the Acting URA station head –Hoima, confirmed the distribution of income tax assessments, saying the exercise intended to remind the business community in Kagadi their obligation to pay taxes.

The LC3 chairperson Kagadi town council, Geoffrey Businge told our reporter that a team of Uganda revenue authority did not notify the town council authority about the income tax assessment exercise.

The Kagadi district woman Member of Parliament Janepher Kyomuhendo Mbabazi has blamed the URA team for issuing income tax assessments before sensitizing the business community on the procedures.

She has asked the people of Kagadi not to Punic as she promised to engage the URA officials to sensitize the communities about paying taxes.

However, Cyrus Kayumba, the Acting URA station head –Hoima said they did the work in accordance to section 95 of the income tax assessment act 1997 cap 349 as amended, which require a business person to register for tax purpose and pay the assessed tax.

The News Editor ,Reporter at Kagadi Kibaale community Radio